India’s central electric vehicle subsidy framework has changed significantly after the closure of FAME-II. From late-2024 onward, the Government of India is implementing a new national scheme called PM E-DRIVE (Prime Minister Electric Drive Revolution in Innovative Vehicle Enhancement).

This article provides a fully updated, numbers-based, category-wise subsidy breakdown for 2026, with official limits, tables, examples — strictly based on government notifications and portals.

1. Is FAME-II Active in 2026?

No.

The FAME-II scheme officially ended, and all central EV subsidies are now governed under PM E-DRIVE.

FAME-II timeline:

- Launched: April 2019

- Effective till: March 2024

- Replaced by: PM E-DRIVE (from October 2024)

Official government source:

https://pmedrive.heavyindustries.gov.in/

2. What Is PM E-DRIVE? (Official Overview)

Scheme Name: PM E-DRIVE

Ministry: Ministry of Heavy Industries, Government of India

Total Outlay: ₹10,900 crore

Scheme Period: 1 October 2024 to 31 March 2026

Objectives

- Accelerate adoption of electric vehicles

- Reduce oil imports and urban pollution

- Support commercial EV segments

- Expand EV charging infrastructure

- Support EV testing and homologation facilities

3. Total Budget Allocation (Official Figures)

| Component | Allocation (₹ crore) |

|---|---|

| Demand incentives (vehicle subsidies) | 3,679 |

| Electric buses (procurement support) | 4,391 |

| EV charging infrastructure | 2,038 |

| Testing agencies & upgrades | 792 |

| Total PM E-DRIVE Outlay | 10,900 |

(Source: Gazette Notification & PM E-DRIVE portal)

4. Core Subsidy Rule (Very Important)

For most vehicle categories:

- Subsidy is linked to battery capacity (₹/kWh)

- Subsidy is capped per vehicle

- Subsidy cannot exceed a percentage of ex-factory price

- Lower of all limits applies

Two different rates apply across the scheme period.

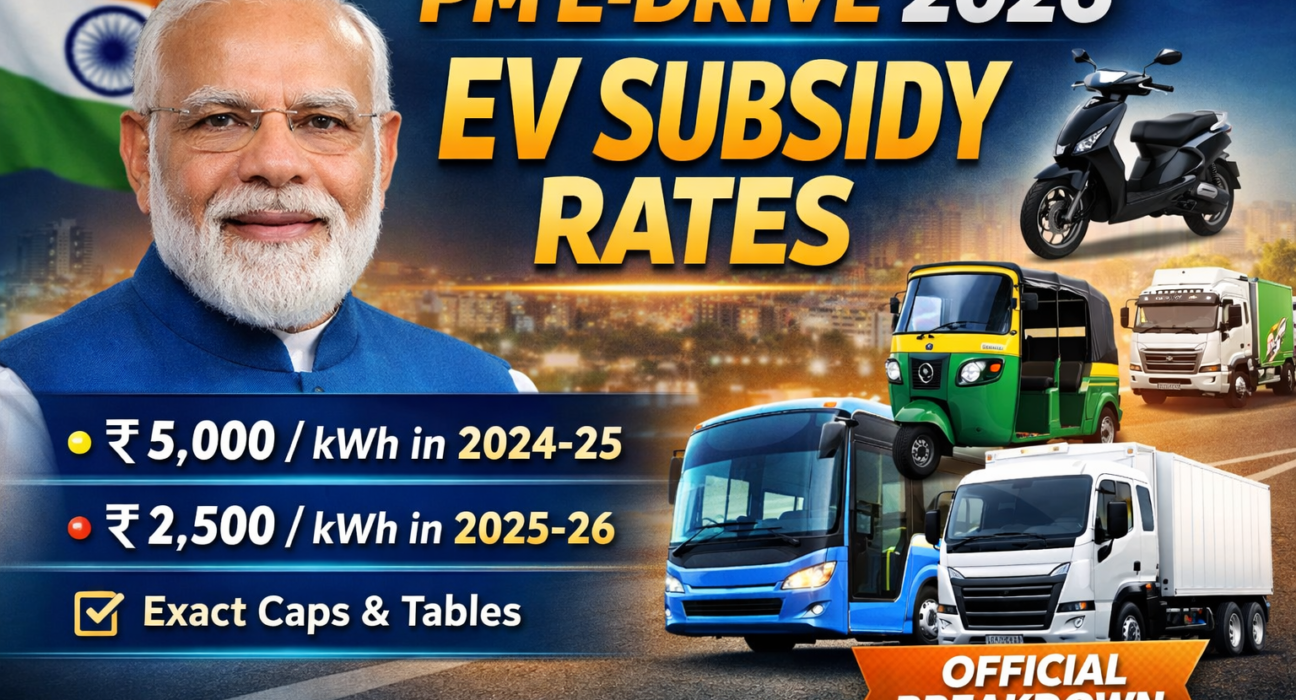

5. EV Subsidy Rates: FY 2024-25 vs FY 2025-26

Key Change You Must Know

The government reduced per-kWh subsidy in FY 2025-26.

| Financial Year | Subsidy Rate |

|---|---|

| FY 2024-25 | ₹5,000 per kWh |

| FY 2025-26 | ₹2,500 per kWh |

6. Category-Wise EV Subsidy Breakdown (Exact Figures)

A. Electric Two-Wheelers (Registered)

| Parameter | FY 2024-25 | FY 2025-26 |

|---|---|---|

| Subsidy rate | ₹5,000 / kWh | ₹2,500 / kWh |

| Maximum subsidy | ₹10,000 | ₹5,000 |

| Price cap | 15% of ex-factory price | 15% of ex-factory price |

| Eligible vehicles | Registered commercial & private |

Example (2026):

- Battery: 3 kWh

- Calculation: 3 × ₹2,500 = ₹7,500

- Cap applied: ₹5,000

- Final subsidy: ₹5,000

B. Electric Rickshaw & E-Cart

| Parameter | FY 2024-25 | FY 2025-26 |

|---|---|---|

| Subsidy rate | ₹5,000 / kWh | ₹2,500 / kWh |

| Maximum subsidy | ₹25,000 | ₹12,500 |

| Price cap | 15% of ex-factory price | 15% of ex-factory price |

Important update:

- Government has announced phase-out of e-rickshaw subsidies after targets were achieved

- Buyers must verify availability on PM E-DRIVE portal before purchase

C. Electric 3-Wheeler (L5 Category)

| Parameter | FY 2024-25 | FY 2025-26 |

|---|---|---|

| Subsidy rate | ₹5,000 / kWh | ₹2,500 / kWh |

| Maximum subsidy | ₹50,000 | ₹25,000 |

| Price cap | 15% of ex-factory price | 15% of ex-factory price |

Example:

- Battery: 10 kWh

- 10 × ₹2,500 = ₹25,000

- Final subsidy: ₹25,000

D. Electric Buses

| Parameter | Value |

|---|---|

| Subsidy rate | ₹10,000 per kWh |

| Maximum subsidy | ₹2 crore per bus |

| Supported under | GCC / STU / PSU procurement |

| Battery size | Typically 200–350 kWh |

Electric buses receive the highest support due to public transport impact.

E. Electric Trucks (Commercial Goods Vehicles)

Electric trucks are covered under “Emerging EV Categories” with a separate formula.

Subsidy is the LOWEST of:

- ₹5,000 × Battery Capacity (kWh)

- 10% of ex-factory price (maximum ₹1.25 crore)

- Maximum incentive allowed based on GVW (Gross Vehicle Weight)

Example:

- Battery: 120 kWh → ₹6,00,000

- Truck ex-factory price: ₹55 lakh → 10% = ₹5,50,000

- Final subsidy: ₹5,50,000

Official reference:

https://pmedrive.heavyindustries.gov.in/

7. How Subsidy Is Given (Buyer Process)

- Buyer selects eligible EV

- Aadhaar-based e-voucher is generated

- Subsidy is adjusted directly on invoice

- OEM claims subsidy from Government

- Buyer pays reduced price upfront

No separate reimbursement is required from buyer side.

8. Central + State Subsidy: Can You Combine?

Yes.

PM E-DRIVE incentives can be combined with state EV policies, such as:

- Road tax exemption

- Registration fee waiver

- Capital subsidy (fleet, charging, manufacturing)

State policies vary and must be checked individually.

9. Key Government Links (Official)

PM E-DRIVE Portal

https://pmedrive.heavyindustries.gov.in/

Ministry of Heavy Industries

https://heavyindustries.gov.in/

Press Information Bureau (EV policy updates)

https://pib.gov.in/

10. Frequently Asked Questions (FAQs)

Q1. Is FAME-II still applicable in 2026?

No. FAME-II has ended. PM E-DRIVE is the only active central EV subsidy scheme.

Q2. Are private electric cars eligible?

No. PM E-DRIVE does not subsidize private electric cars.

Q3. Are electric trucks subsidized?

Yes. Commercial electric trucks are supported with battery-linked incentives and price caps.

Q4. Has subsidy for electric 3-wheelers ended?

Subsidies are being phased out once category targets are met. Availability must be verified at time of purchase.

Q5. Why was subsidy reduced in 2026?

The government follows a declining incentive model to reduce dependence on subsidies as EV adoption matures.

Final Takeaway

PM E-DRIVE is not a continuation of FAME-II, but a more targeted, infrastructure-focused EV policy for 2024-26.

- Highest support now goes to buses, trucks, and commercial EVs

- Light EV subsidies are reduced but still active

- Charging infrastructure receives massive backing

- Buyers must check real-time eligibility before purchase